Blogs

Read our blogs on business owner transition.

Read our blogs on business owner transition.

A dramatic (if not brutal) example of reaction to sudden change has stayed with me from my childhood. I witnessed how a live crayfish shows limited reaction when the water it is in is slowly raised in temperature until it is ultimately cooked versus the violent response if one is dropped in boiling water*.

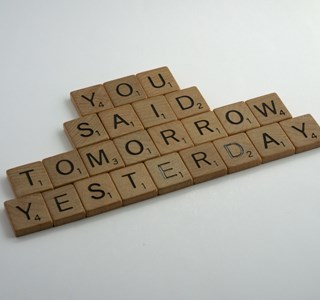

In a somewhat similar way, us humans are far better equipped to handle gradual or staged change. The major events in our lives go more smoothly for us if there is the option to traverse them over time.

When Markus Persson the founder of “Minecraft”, sold his business to Microsoft for some $3.8 Billion he didn’t get much understanding on social media when he shared his struggle to adjust when stepping away from his business so suddenly.

Business owners need to target more than just a good financial outcome when contemplating an exit. Stepping back from business ownership is a massive change, yet there are a number of useful ways to manage the potential associated effects. While Family Succession and Management Buy Out have their respective pitfalls they do afford the owner advantages of both an option to first reduce their level of day to day operational responsibility and flexibility of timetable. Longer term the retention of some involvement through partial ownership can also be available.

Many baby boomer business owners are still running their businesses when earlier predictions saw more of them exiting. One of the reasons is a perception by a number of them that what they receive for being 100% committed to their business isn’t available to them if they step away … either financially or in terms of what they enjoy doing.

The option to take on a business partner from outside the business, someone with relevant experience, skills, capital and networks can remedy this dilemma and provide additional benefits. This is called a Management Buy In. Reliance of the business on the owner can be reduced. The owner can scale down their daily involvement if they wish, according to their preferred timetable. This can happen while they continue to influence the growth of value in the business toward a more profitable eventual exit to the business partner. The right business partner can be expected to contribute new capability, energy and networks.

Yet how does one find the ideal person and how can you have confidence that the relationship will be positive and deliver the benefits you seek?

Many business owners do not realise that a service exists to find talented business partners using executive search (head hunting) techniques. This service also provides a de-risked structure and process to manage the transition for business owners who can expect to see their business meaningfully grow in value. This happens while they nonetheless stage a reduction in the business’s day to day reliance upon them, to a timetable of their own choosing.

The health, wellbeing and financial benefits of exercising a choice that the crayfish doesn’t have, a choice for gradual change, are very compelling.

* Footnote: current practice is to humanely kill a crayfish before cooking it .

About the Author: Peter Roborgh is the South Island Partner of Platform 1 which specialises in using executive search techniques to find people with capability and equity for SME business owners wanting to transition. www.platform1.co.nz